24 Aug Tips On Saving for Your Child’s Tuition

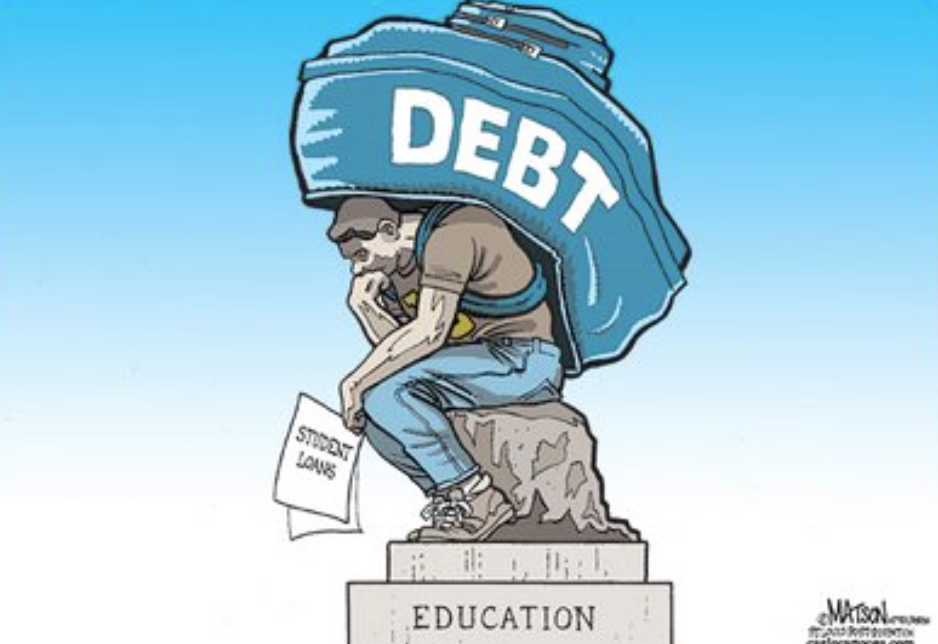

Is the sheer thought of paying for 4+ years of college for your child enough to make you feel discouraged and overwhelmed? It is no secret that the cost of college tuition is on the rise and that adults around the nation are struggling with covering the price of higher education. In addition to the effect that tuition prices have on you as parents – who wants their child to finish their college career with thousands of dollars worth of student loans looming over their heads? These simple tips can help you get a head start on saving today.

1. Start Saving Early

If you haven’t already started putting money away before you have children, opening up a savings account when your children are born is a smart course of action. This will allow you to start saving from the get-go and avoid waiting until your child’s 8th birthday to really get a handle on things. A simple way to start this process is to seek savings and personal banking advice from a Bank of the Lowcountry banker at your local branch.

2. Make Deposits Regularly

It is important to get into the habit of making deposits into the designated college savings account regularly- no matter how small the deposits may be. Whenever you have extra cash lying around, deposit it right away before something else catches your eye. These deposits will add up over time and could end up making a big difference 18 years in the future.

3. Write Down Your Spending Habits

Challenge yourself by writing down your spending habits for one entire month. You can use a journal or mobile app to do the logging. By writing down what you spend, you will be able to see exactly where your money is going. This will also aid in cutting costs by helping you decide what your must-haves are and what you can truly live without. Don’t be surprised if by the end of the month you’re asking yourself if your daily Starbucks latte is really necessary.

While paying for college can be stressful and frightening at times, it doesn’t have to be. It is imperative to make smart decisions about saving your money from the start. Remember: the more money you save now, the less you will have to borrow later.

No Comments